by | Jul 1, 2020 | Tax Tips and News

When will the IRS start processing CAF requests?

The Internal Revenue Service last Thursday announced that it is beginning to process Centralized Authorization File requests, like Forms 2848 and 8821. This comes two weeks after the IRS issued an update for reporting agents saying they have resumed processing Forms 8655, signaling that the IRS is trying to address its substantial workload in the looming shadow of the July 15 deadline.

As previously noted on Taxing Subjects, CAF was suspended in April alongside a number of other services to prevent IRS employees from contracting COVID-19. While the coronavirus has not gone away, the IRS said it is taking steps to safely address its backlog and start processing new requests. Social distancing is one of the methods being used at their facilities: “CAF units at Memphis and Ogden are currently operational but are operating with limited staffing.”

How can tax preparers help CAF processing go faster?

Having fewer employees on site to process power-of-attorney and tax-information-authorization requests could mean longer wait times than normal, which would be worse if there are issues with submissions. That’s why the IRS is asking preparers to help reduce duplicate-form delays by double checking documents before faxing them—and, of course, only sending one fax.

“Duplicate requests (sending the same request for access to a taxpayer’s account more than once) put a strain on operations,” the IRS explained. “Sending in duplicate Forms 2848 (Power of Attorney), and 8821 (Tax Information Authorization), results in processing delays, as all requests must be researched and reviewed.”

Source: IRS e-News for Tax Professionals 2020-26

– Story provided by TaxingSubjects.com

by | Jul 1, 2020 | Tax Tips and News

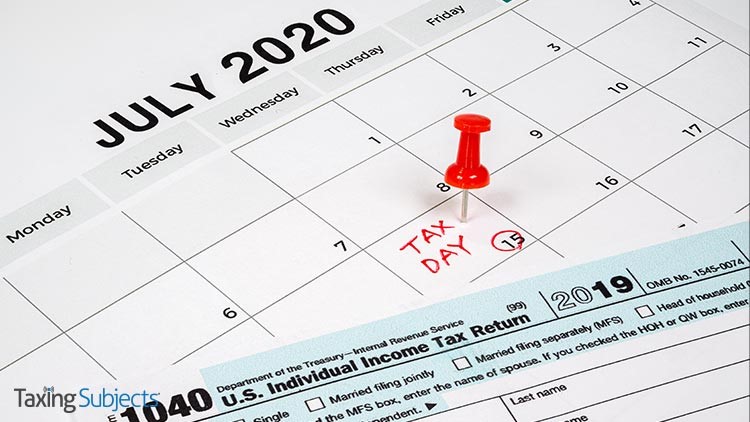

The Internal Revenue Service has some bad news for taxpayers hoping that the tax filing and payment deadlines would get pushed back again. In a recent IRS Newswire press release, the agency said taxpayers should either file their tax return or an extension by July 15.

What is the deadline for taxpayers who request an extension?

There are three important deadlines for taxpayers who want to get an extension:

- Request the extension by July 15, 2020

- Pay tax owed by July 15, 2020

- File the now-extended tax return by October 15, 2020

The IRS explained that there are two ways to secure an extension: file Form 4868 or pay tax owed. They also said that paying can “save a step” on July 15: “When getting an extension by making a payment, taxpayers do not have to file a separate extension form and will receive a confirmation number for their records.” Besides, missing the payment deadline can add penalties and interest to your tax bill.

How do I pay my tax bill?

The IRS suggested five ways to pay taxes: IRS Direct Pay, the Electronic Federal Tax Payment System (EFTPS), third-party payment processors for debit and credit cards, a check or money order, or even a loan. Those who can’t pay all of what they owe can request a payment agreement—like an Online Payment Agreement, Installment Agreement Request, temporarily delayed collection, or an Offer in Compromise—which the agency said can mitigate potential penalties and interest.

“Though interest and late-payment penalties continue to accrue on any unpaid taxes after July 15, the failure to pay tax penalty rate is cut in half while an installment agreement is in effect,” the IRS explained. “The usual penalty rate of 0.5% per month is reduced to 0.25% for the calendar quarter beginning July 1, 2020, the interest rate for underpayment is 3%.”

What about state tax filing deadlines?

The IRS also noted that state tax filing deadlines could be different from the July 15 filing deadline. Check out our “Did COVID-19 Change My State Individual Income Tax Deadline” blog to double check your state deadline.

Source: IR-2020-134

– Story provided by TaxingSubjects.com